Sunshine with the Seal of Quality.

At Renova Energy, we believe in powering your life with only the best. That’s why we’ve carefully selected quality solar panels known for their exceptional durability, efficiency, and performance. Our commitment to excellence ensures you receive robust products that give you peace of mind and energy savings for years to come.

Brands We Sell:

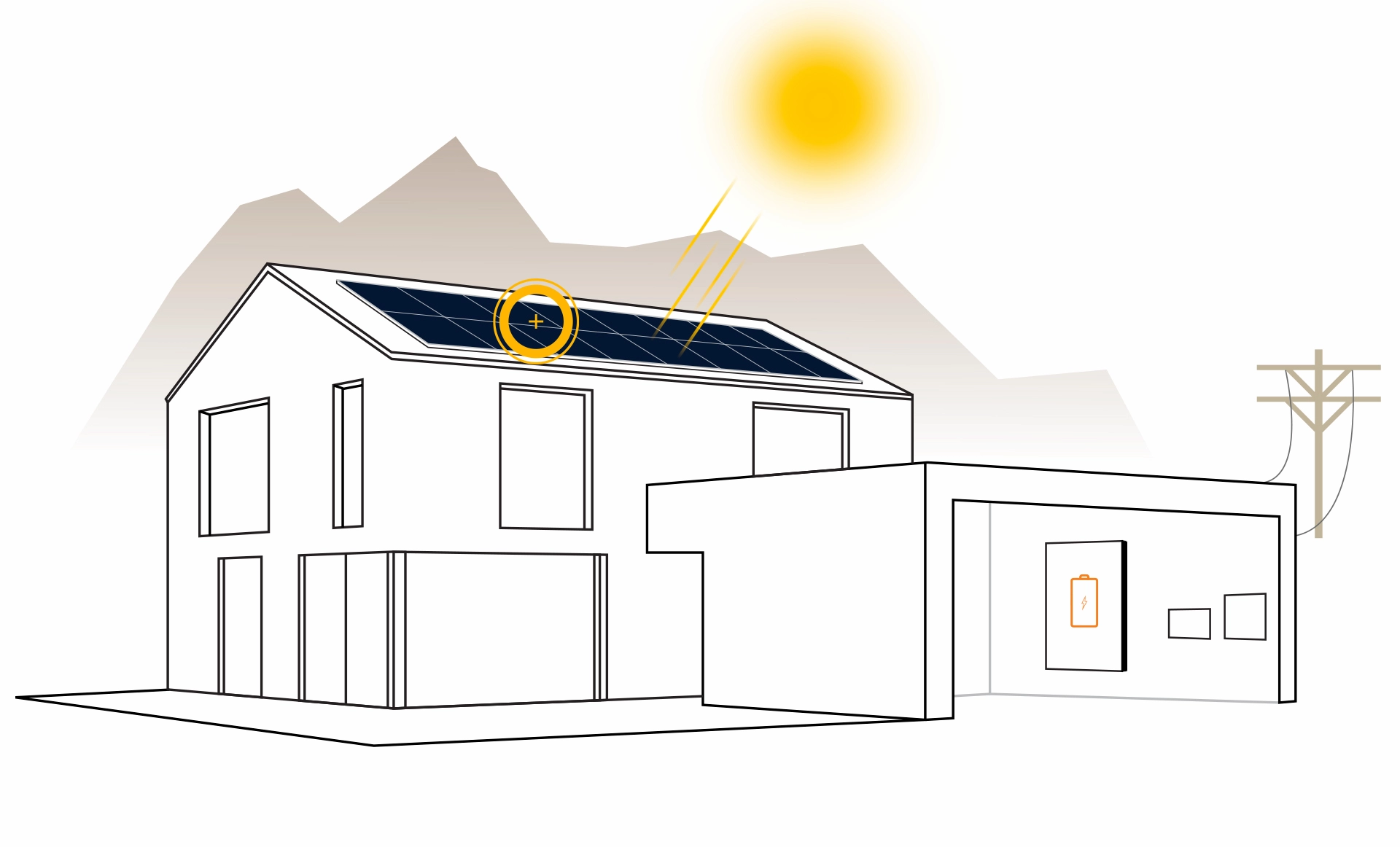

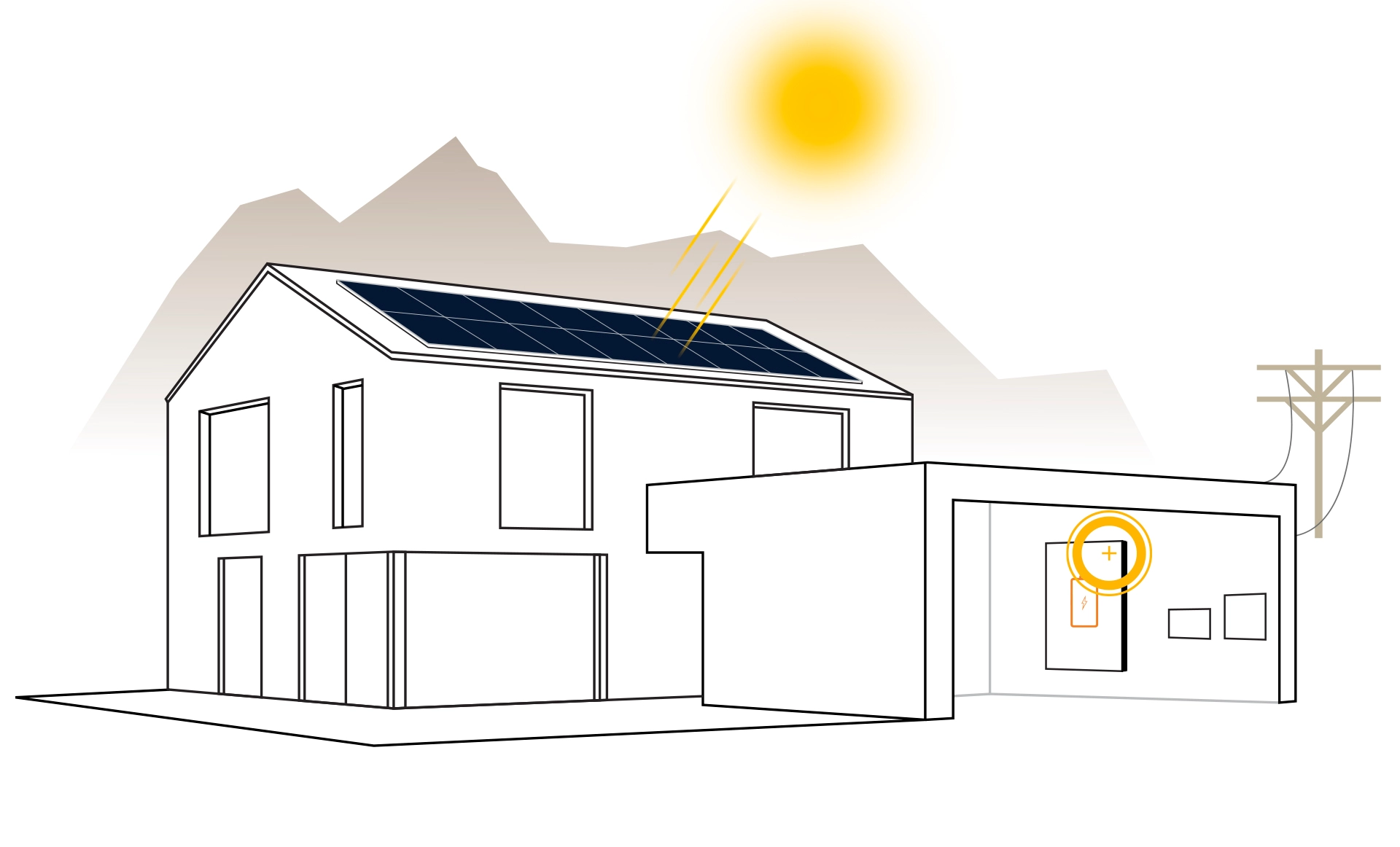

How A Mycrogrid™ Works

Why our Solar Panels Shine the Brightest

Top-notch quality

These solar modules are designed to deliver superior efficiency and durability, maximizing energy production for your home or business.

Impressive energy output

With industry-leading energy outputs, you get more energy for every panel.

Built to last

Engineered to withstand harsh conditions, high temperatures, heavy winds, and dust-perfect for desert environments.

Reliable performance

Tested and certified by third-party labs to ensure reliable and consistent performance.

Eco-friendly and sustainable

Eco-friendly processes and materials make our panels a greener choice than other models.

Other

Eco-friendly processes and materials make our panels a greener choice than other models.

Get a Quote

Join the solar revolution and make a positive impact on the environment with our expert solar panel installations.

Solar Panel

FAQs

The quality solar panels that Renova provides deliver up to a 30-year product and production warranty. Many times, other manufacturers boast a 25-year power warranty but only offer a 10-year or 12-year product warranty. These warranties may also require homeowners to pay for shipping or crew expenses to repair the module if there’s a problem. Renova guarantees that your panel will still produce 92% of the original amount of energy at Year 25 – no other panel even comes close.

In order to offer a competitive price, many companies propose a system that only covers a percentage of your electricity usage. The result is an electric bill that will keep getting higher as electric prices increase. Renova Energy strives to offset 95-100% of your electric bill in order to keep your total cost for electricity as low as possible.

Renova Energy offers the most advanced and efficient solar panels in the industry, backed by third-party testing and verification from American companies to ensure they withstand the harsh desert environment.